Right of Use Asset Ifrs 16

Credit Right of Use Asset Accumulated Depreciation 92683. Jennifer has over 16 years of experience in audit and technical accounting.

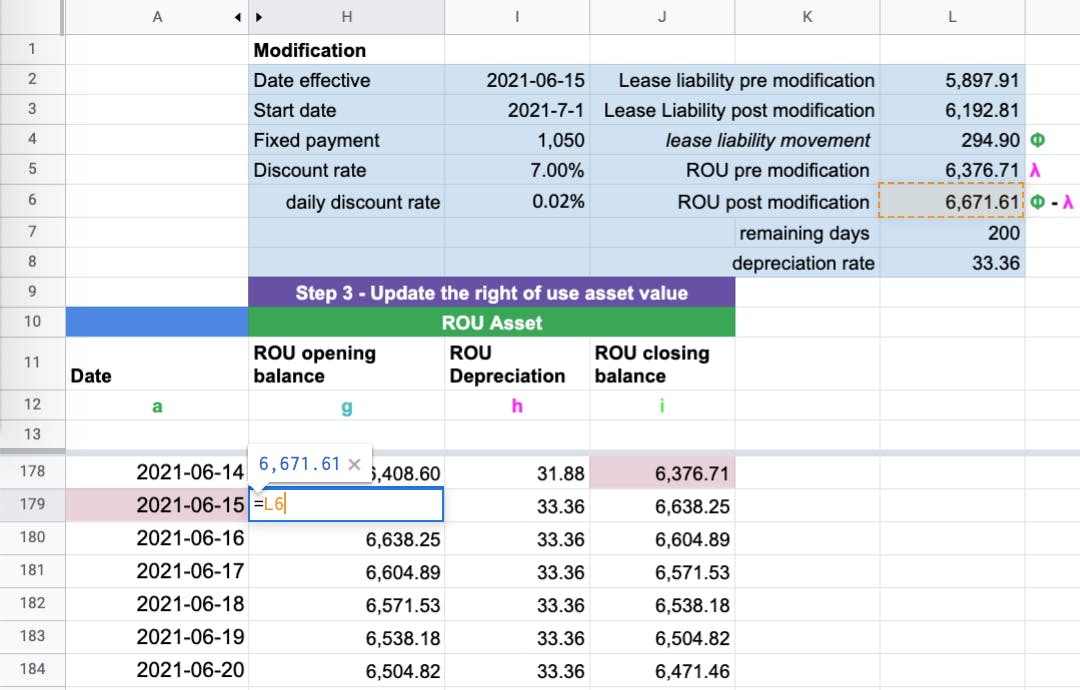

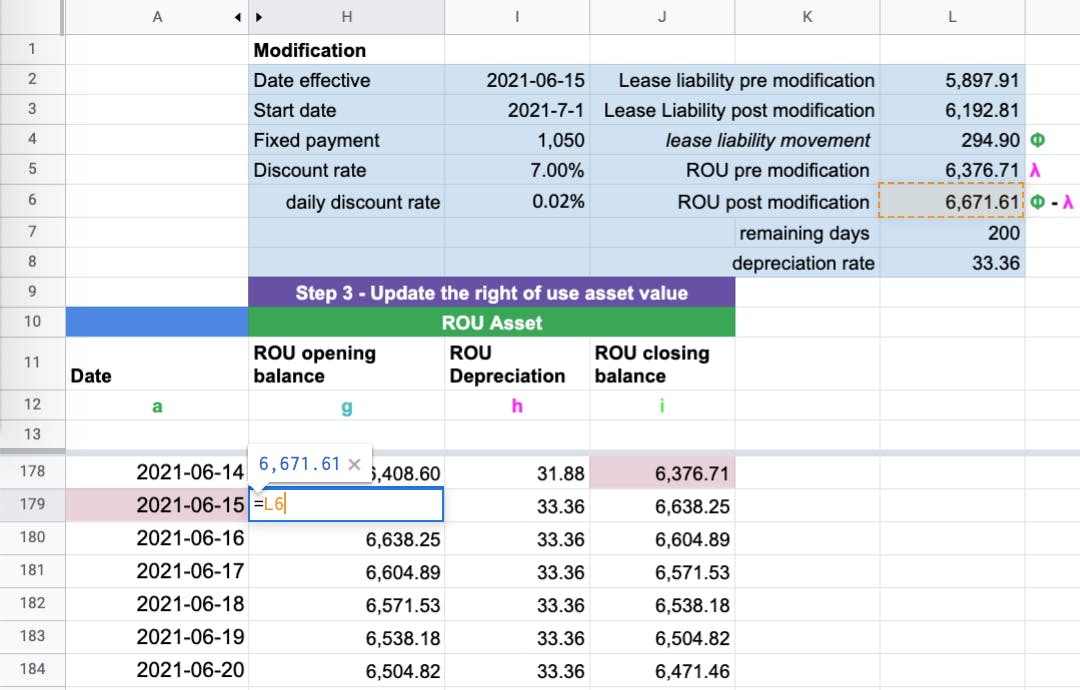

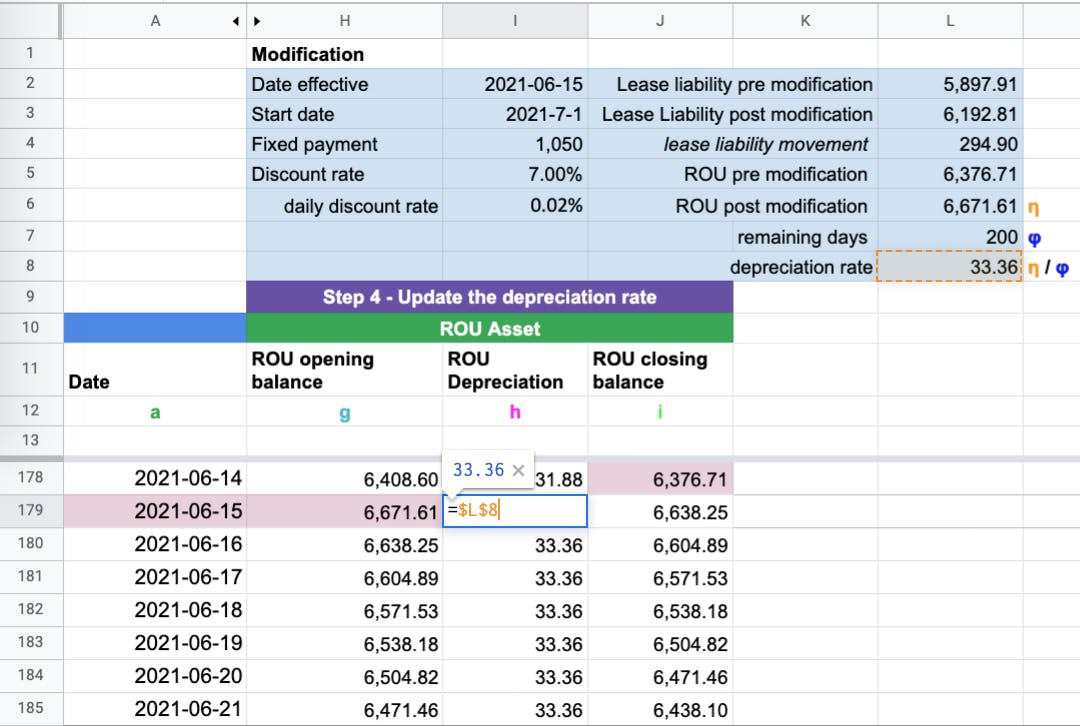

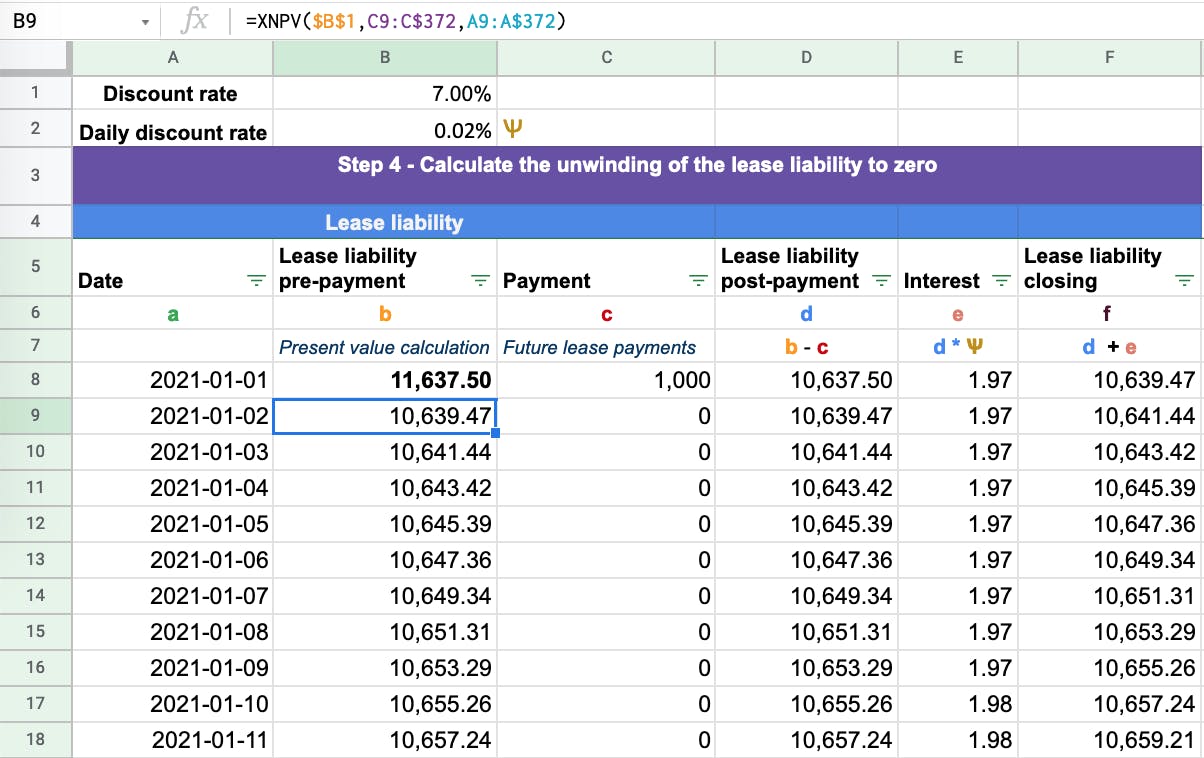

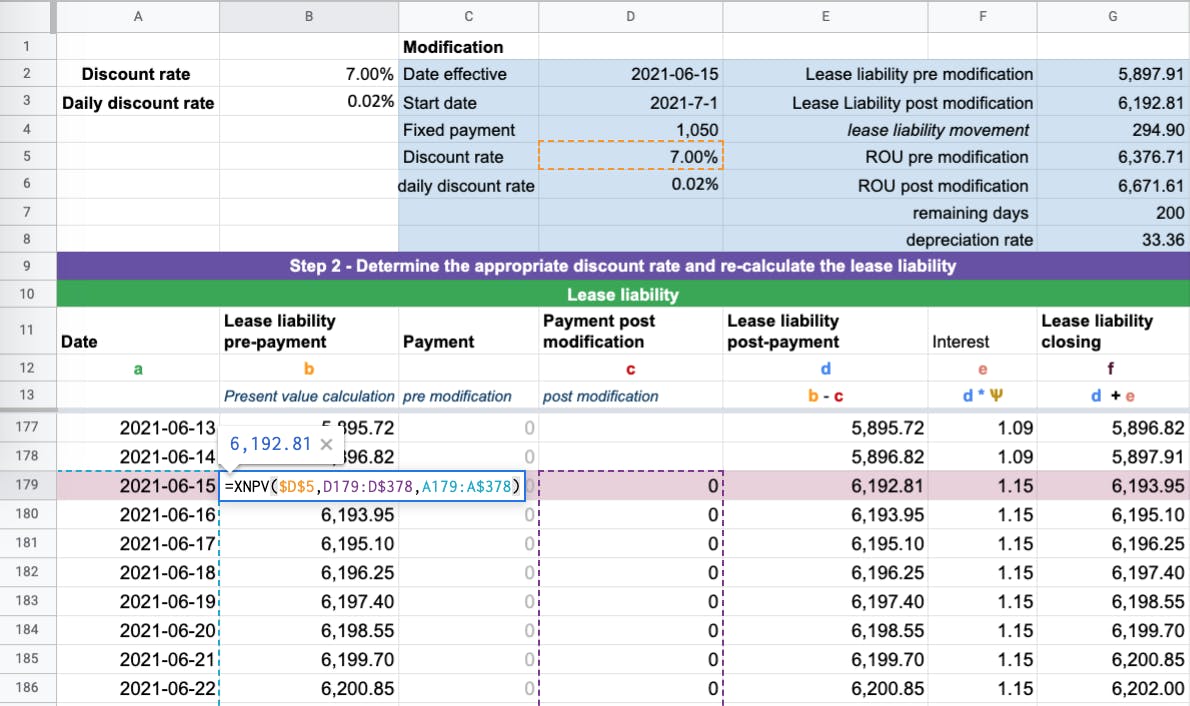

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

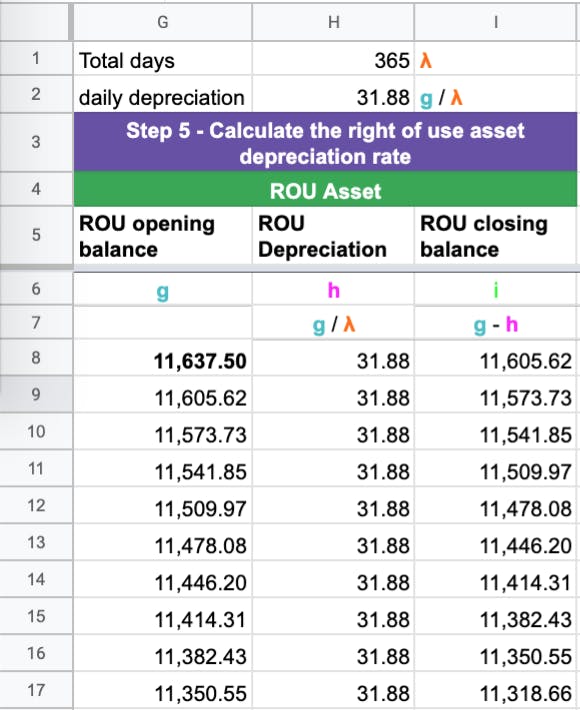

A Calculate the opening balance of the right of use asset and divide by the total number of days the asset will be used.

. IFRS 16 Leases in the statement of cash flows IAS 7 On 1 January 20X4 ABC entered into the lease contract. Right-of-use asset under IFRS 16. Initial right-of-use asset equals to CU 20.

Here are the steps to calculate this. The lease assets or right-of-use assets will need to be depreciated using straight-line depreciation method while on the lease liabilities side interest expense will be recognized. The right-of-use asset.

Amount of lease liability plus Lease payments made in advance plus Initial direct costs. The Right-Of-Use asset in IFRS 16. If we look at the definition of cost within IFRS 16 this means that the initial measurement of the right-of-use asset is calculated as follows.

With the previous standard IAS 17 this. IFRS 16 may impact both a CGUs carrying amount and the way the recoverable amount of the CGU is measured. Jennifer has over 16 years of experience in audit and technical accounting.

Ii the right-of-use asset relates to a class of PPE to which the lessee applies IAS 16s revaluation model in which case all right-of-use assets relating to that class of PPE can. Initial lease liability Plus. IFRS 16 assets.

Impairments are applicable to both tangible and intangible assets including property plant equipment goodwill software or right-of-use ROU assets. If the carrying amount is reduced to zero any further reduction is recognised. Under IFRS 16 the entity must recognize a right-of-use asset corresponding to the present value of the lease payments to present value.

The new leases standard IFRS 16 Leases applies to annual periods beginning on or after 1 January 2018 so. The details are as follows. The cash flow forecast and.

Identifying the IFRS 16 presentation and disclosure requirements and providing a series of examples illustrating one possible way they might be presented. Remeasurements of the lease liability are treated as adjustments to the right-of-use asset. IFRS 16 Leases brings along with it the concept of a right-of-use asset.

A classification distinction between operating and finance leases does not exist under IFRS 16. Debit Right of Use Asset Depreciation 92683. IFRS 16 then specifies how to measure both elements initially and subsequently how to account for remeasurements.

IFRS 16 defines a lease as A contract or part of a contract that conveys the right to use an asset for a period of time in exchange for consideration. W 10000 of annual lease cost and 7000. A right-of-use asset is an asset that represents a lessees right to use an underlying asset for the lease.

This journal entry should be entered on a monthly basis. Read a summary of IFRS 16 lease accounting with a full example journal entries and an explanation of disclosure requirements. Elements to consider include.

In principle under IFRS 16 the rights of use are separately identified with. Ad Schedule A Free Demo With The Lease Accounting Experts At LeaseQuery Today. In order for such a.

IFRS 16 comprises rules for identifying and accounting for the rights of use arising from the contracts. IFRS 16 introduces a single lessee accounting model and requires a lessee to recognise assets and liabilities for all leases with a term of more than 12 months unless the underlying asset is. Ad Schedule A Free Demo With The Lease Accounting Experts At LeaseQuery Today.

There are four components that make up the Right of use assets under IFRS 16 ie. Rather a single model approach is applied. From the commencement date onwards the cost model should be applied in measuring the right-of-use.

How to amend impairment models for right-of-use assets under IFRS 16.

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

0 Response to "Right of Use Asset Ifrs 16"

Post a Comment